Support CleanTechnica’s work through a Substack subscription or on Stripe.

Or support our Kickstarter campaign!

The question around electric vertical takeoff and landing (eVTOL) aka Jetsons air taxi certification has shifted. It is no longer about whether regulators will create a pathway. Both the FAA and EASA have done that work. The FAA finalized powered lift operational rules in 2024 and published Advisory Circular 21.17-4 in 2025, defining how type certification for powered lift aircraft would proceed. EASA published its Special Condition VTOL framework back in 2019 and followed with means of compliance and guidance material. The regulatory scaffolding exists. The real question is whether any of these firms can close engineering risks and finance the final stages of certification before their capital runs out. After that, it’s whether any of them can possibly make any money. Let’s start with the first hard part.

When I apply a Flyvbjerg reference class forecasting lens, I do not compare eVTOLs to incremental aircraft derivatives, I compare them to novel category aircraft. Tiltrotor programs such as the AW609 are closer analogues. That aircraft first flew in 2003 and has faced a certification timeline stretching into decades, with repeated target revisions reported over the years. It is not a perfect comparison, but it captures the dynamic of new flight modes, new safety interpretations, and regulatory friction. Clean sheet transport aircraft also provide perspective. Even Airbus A350 deliveries slipped relative to earlier targets despite massive resources and mature regulatory frameworks. Electric propulsion certification on a simple fixed wing trainer, such as the Pipistrel Velis Electro certified by EASA in 2020, shows that batteries alone are not the bottleneck. Powered lift combined with distributed propulsion, fly by wire control systems, crashworthiness requirements, and new safety objectives is the complex part. The reference class says that novel aircraft categories tend to experience long tail schedule outcomes, i.e. significant schedule overruns. That does not make 2027 impossible. It makes it statistically optimistic.

Engineering complexity is only half the story. Cash burn curves in aerospace are not flat. They rise as programs move from prototype to certification and industrialization. Early stage burn is dominated by engineering and prototyping. Late stage burn includes conforming aircraft builds, destructive testing, environmental qualification, software assurance teams, documentation expansion, quality system audits, supplier traceability, and production tooling. Certification flight testing under Type Inspection Authorization requires production representative aircraft, not rough prototypes. That means higher build costs and more inventory tied up in hardware. At the same time, production readiness activities overlap with certification work. Factories are staffed, suppliers are qualified, and parts are purchased before revenue begins. This is where burn often doubles.

Public filings already show escalation. Archer’s Q3 operating expenses rose 43% year over year from $122.1 million to $174.8 million. Its full year operating expenses increased from $446.9 million in 2023 to $509.7 million in 2024. Joby reported total operating expenses of $535.4 million for the first nine months of 2025 versus $447.0 million in the comparable 2024 period, a rise of about 20%. BETA reported R&D up 17% and G&A up 50% year over year for the first nine months of 2025, tied explicitly to development, testing, certification, and prototype production. These are not stable burn profiles. They are rising cost structures moving into later stage work.

If we treat 100% burn escalation as the most likely late stage scenario, which aligns with historical aerospace behavior when certification and industrialization overlap, the runway picture sharpens. BETA appears to have roughly $1.7 billion in liquidity after its IPO. Its recent burn approximates $300 million per year. Doubling that to $600 million per year provides roughly 2.8 years of runway from late 2025, carrying it into mid to late 2028. Joby has roughly $1.55 billion in liquidity combining cash and recent equity raise proceeds. With a current burn near $550 million per year, doubling to $1.1 billion per year yields around 1.4 years of runway. That places funding pressure in early to mid 2027. Archer has roughly $1.64 billion in liquidity and a current burn near $500 million per year. Doubling to $1.0 billion per year yields about 1.6 years of runway, also pointing to funding pressure during 2027. Vertical Aerospace, with around $110 million equivalent cash and expected annual outflows near $215 million, does not have runway to absorb any meaningful escalation without major new capital.

This reframes 2027 certification probability. Engineering closure may be possible for one or two leaders. But if those leaders must raise substantial capital in 2026 or 2027 to sustain peak burn, the financing event itself becomes a schedule risk. Equity raises dilute and can reset strategy. Debt financing is expensive and limited for pre revenue aerospace firms. If capital markets tighten, burn driven certification timelines stretch. Under a doubled burn base case, the probability of at least one FAA eVTOL type certificate by end 2027 falls into roughly a 20% to 30% band. The probability of multiple certifications falls below 15%. The modal year shifts toward 2028.

BETA is the most interesting capital case. It likely has runway to carry its CX300 conventional takeoff and landing (CTOL) derivative through certification under a doubled burn assumption. That matters. It gives BETA endurance. However, the CX300 is not a clean sheet CTOL optimized purely for fixed wing performance. It shares the ALIA eVTOL airframe. It was designed around commonality with the VTOL configuration. That brings structural compromises. Wing loading, fuselage form factor, structural reinforcement, and battery packaging were not optimized solely for runway based efficiency. It is a pragmatic certification path, not an aerodynamic ideal. Certifying that derivative CTOL is financially plausible within the current capital envelope. Designing, certifying, and industrializing a clean sheet optimized and commercially viable CTOL would be a separate program with its own multi year burn curve. That extends beyond the current schedule. BETA may have the capital base to contemplate such a pivot in the future, but not within the same 2026 to 2028 window tied to the existing certification effort.

Joby and Archer face a different tension. They are further along the powered lift certification path. Both have signaled entry into later stage FAA testing milestones. Both also face burn profiles that under a doubled scenario imply capital raises before certification is complete. That does not mean they will fail. It means their timelines are sensitive to financing windows. Certification in 2027 requires not just successful flight tests but uninterrupted capital flow.

Vertical illustrates the constraint case. Without major new funding, its certification timeline is secondary to survival. That is not unusual in aerospace. Novel aircraft programs often require recapitalization during late stage certification. The difference here is that all of these firms are pre revenue and operating in capital markets that are less forgiving than during the SPAC wave.

What would make 2027 realistic? Conforming aircraft in for credit FAA or EASA flight testing by mid 2026. Stable configuration freeze with no major redesign announcements. Issue paper closure pace consistent with 12 to 18 months remaining work. Clear production readiness planning without exponential hiring spikes. And critically, sufficient liquidity to avoid emergency capital raises during TIA.

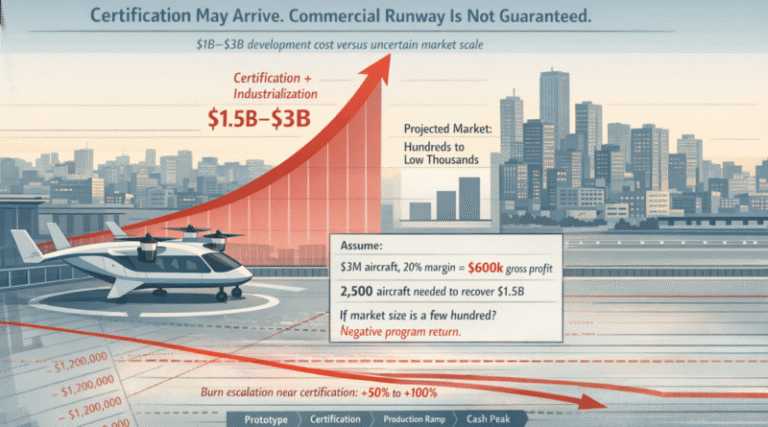

When you put credible certification costs in the $1B to $3B range together with timelines stretching into 2028 or later, the commercial math becomes uncomfortable. If an eVTOL sells for $3M and achieves a 20% gross margin, that is $600K of gross profit per aircraft. Recovering $1.5B in certification and industrialization costs would require roughly 2,500 aircraft just to break even at the program level, before corporate overhead, financing costs, warranty reserves, and ongoing R&D. Yet even optimistic independent assessments of the urban air taxi market tend to cluster in the low thousands globally over a decade, not per year, and more skeptical analyses suggest a few hundred units in early waves. If the realistic addressable market in North America and Europe is measured in hundreds per region and infrastructure constraints limit density of operations, it is fair to ask whether any single certified eVTOL will have enough commercial runway to amortize its development costs without sustained subsidies, unusually high pricing power, or a pivot to higher-value niches such as defense or specialized logistics.

Downwash and outwash are not minor engineering details and add another commercial challenge. They translate directly into safety buffers, land use constraints, and cost multipliers. FAA testing has documented rotorwash velocities that can exceed commonly referenced safety thresholds well beyond the immediate touchdown area, with some configurations producing near hurricane force winds close to the aircraft and sustained high velocity outwash extending outward. That creates risks to pedestrians, loose debris, rooftop equipment, façade elements, and adjacent traffic. To manage that hazard field, vertiports must incorporate defined caution areas, setbacks, barriers, and controlled access zones. Every meter added to that safety envelope increases structural reinforcement requirements, reduces the number of viable rooftop sites, and lowers movements per hour because aircraft cannot be tightly sequenced in confined urban airspace. The result is fewer operations on more expensive real estate, precisely in the locations that were supposed to enable high volume urban air mobility. When a sector is already facing $1B to $3B in certification and industrialization costs and a market measured in hundreds to low thousands of aircraft, adding hurricane force rotorwash constraints compounds the economic challenge. It narrows the feasible site inventory, increases capital intensity per pad, reduces throughput, and pushes per trip economics in the wrong direction.

Certification is a milestone, not a finish line. Even if one firm achieves FAA or EASA type certification in 2027, it still must ramp production, manage supplier risk, and prove unit economics. The burn curve does not flatten at certification. It often peaks during industrialization. That adds another layer of capital endurance to the story.

The eVTOL sector has matured from Jetsons speculation to regulatory uncertainty to uncomfortable capital realism. The rulebooks exist. The engineers are flying prototypes. The determining factor for 2027 will be whether at least one firm can align engineering closure with sufficient liquidity to survive the doubled burn of late stage certification, and then—unlikely—actually turn into an actually profitable firm. On current numbers, BETA has fiscal endurance for certification, if not a market, for its derivative CTOL. Joby and Archer have strong positions but will undoubtedly need even more capital before 2028. Vertical does not have runway without major financing. The distribution of outcomes favors 2028 as the first broadly credible certification year, with 2027 remaining possible but narrow. The distribution of of outcomes for any of them turning into profitable ventures is much less optimistic.

Support CleanTechnica via Kickstarter

Sign up for CleanTechnica’s Weekly Substack for Zach and Scott’s in-depth analyses and high level summaries, sign up for our daily newsletter, and follow us on Google News!

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Sign up for our daily newsletter for 15 new cleantech stories a day. Or sign up for our weekly one on top stories of the week if daily is too frequent.

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy